45 what coupon rate should the company set on its new bonds if it wants them to sell at par

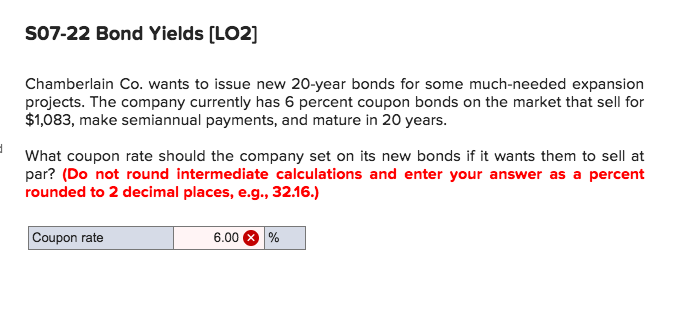

home.treasury.gov › newsPress Releases | U.S. Department of the Treasury April 21, 2022 Readouts READOUT: U.S. Secretary of the Treasury Janet L. Yellen’s Meeting with Swiss Finance Minister and Federal Councillor Ueli Maurer and Swiss National Bank Chairman Thomas Jordan Chamberlain Co. wants to issue new 20-year bonds for some ... The company currently has 6 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Advertisement simranstory9180 is waiting for your help. Add your answer and earn points. Answer 1 jepessoa Answer: 5.36%

7.3.docx - 1. Coccia Co. wants to issue new 20-year bonds ... The company should set the coupon rate on its new bonds equal to the required return; the required return can be observed in the market by finding the YTM on outstanding bonds of the company. Enter 40 ±$1,075 $80/2 $1,000 N I/Y PV PMT FV Solve for 3.641% 3.641% × 2 = 7.28%

What coupon rate should the company set on its new bonds if it wants them to sell at par

Quiz 6 PDF - 1.BDJ Co. wants to issue new 21-year bonds ... What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate 7 .8 2 ± 1 .0 % % Explanation: The company should set the coupon rate on its new bonds equal to the required return of the ... › filing-reporting › traceFrequently Asked Questions (FAQ) about the Trade ... - FINRA Apr 09, 2020 · For example, if Firm A sells $100,000 (par value) to Firm B, which in turn executes 10 sales to customers at $10,000 each, Firm A should report a sale of $100,000 to Firm B and Firm B should report a purchase of $100,000 from Firm A. Firm B also should report 10 sales to customers of $10,000 each. (Solved) - What coupon rate should the company set on its ... BDJ Co. wants to issue new 10-year bonds for some muchneeded expansion projects. The company currently has 8 percent coupon bonds on the market that sell for $1,095, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

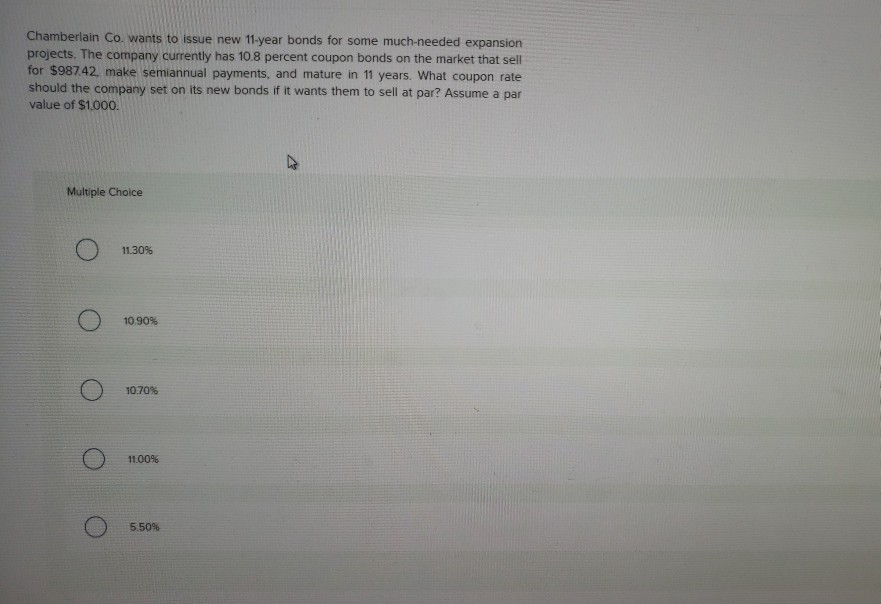

What coupon rate should the company set on its new bonds if it wants them to sell at par. (Solved) - BDJ Co. wants to issue new 19-year bonds for ... What coupon rate should the company set on its new bonds if it wants them to sell at par? BDU Co. wants to issue new 19-year bonds for some much-needed expansion projects. The company currently has 10.3 percent coupon bonds on the market that sell for S1.143, make semiannual payments, have a S1.000 par value, and mature in 19 years. OneClass: Chamberlain Co. wants to issue new 20-year bonds ... Seether Co. wants to issue new 13-year bonds for some much-needed expansion projects. The company currently has 9.8 percent coupon bonds on the market that sell for $868.69, make semiannual payments, and mature in 13 years. What coupon rate should the company set on its new bonds if it wants them to sell at par FINAN EXAM 3 Flashcards | Quizlet YTM with Annual Coupons: Consider a bond with a 10% annual coupon rate, 15 years to maturity and a par value of $1000. The current price is $928.09. - Will the yield be more or less than 10%? 15 N - 928.09. › daily-newsMilitary Daily News, Military Headlines | Military.com Daily U.S. military news updates including military gear and equipment, breaking news, international news and more.

(Get Answer) - What coupon rate should the company set on ... What coupon rate should the company set on its new bonds if it wants them to sell at par? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Ashok Co. wants to issue new 19-year bonds for some ... The company currently has 8.2% coupon bonds on the market that sell for $1,148.09, make semiannual payments, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1,000. 2 See answers Advertisement tallinn The coupon rate would be is = 6.8% Answer in Finance for rim #9185 - Assignment Expert What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 's Complete Business News Resource | Crain's Chicago ... Read the latest business news and analytics including healthcare, real estate, manufacturing, government, sports and more from Crain's Chicago Business.

Business Finance Test 2 Flashcards - Quizlet You want to buy a new sports coupe for $74,500, and the finance office at the dealership has quoted you a loan with an APR of 6.9 percent for 36 months to buy the car. What is the effective annual rate on this loan? Effective annual rate 7.12 ± 1% One of your customers is delinquent on his accounts payable balance. Finance Midterm 1 Flashcards | Quizlet LKM, Inc. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $972.78, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Tickets & Movie Times - Fandango Buy movie tickets in advance, find movie times, watch trailers, read movie reviews, and more at Fandango. Bond Yields Giles Co. wants to issue new 20-year bonds Bond Yields Giles Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,062, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Pembroke Co wants to issue new 20 year bonds ... - Course Hero Pembroke Co wants to issue new 20 year bonds for some much needed expansion from FINANCE 11:373:353 at Rutgers University

quizlet.com › 543261556 › finance-exam-2-flash-cardsFinance Exam 2 Flashcards - Quizlet RTE Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,070.35. However, RTE Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on RTE Inc.'s bonds?

RAK Co. wants to issue new 20-year bonds for some much ... The company currently has 5.7 percent coupon bonds on Correct answer to the question RAK Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 5.7 percent coupon bonds on the market that sell for $1,048, have a par value of $1,000, make semiannu - e-answersolutions.com Subject English History

› discounted-cash-flow-analysisDiscounted Cash Flow Analysis: Tutorial + Examples The Coupon refers to the payments made as part of the bond agreement to the bondholder for each year. i is the interest rate in decimal form. This is the yield to maturity that the bond buyer is targeting. Value at Maturity is the final payment the bondholder gets back at the end, or the “par value” of the bond.

please fill in the blanks as a formula only K Chamberlain Co. wants to issue new... - HomeworkLib

FIN401 Exam 2 (Chapter 7) Flashcards - Quizlet Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 10% coupon bonds on the market that sells for $1,063, makes semiannual payments and matures in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Post a Comment for "45 what coupon rate should the company set on its new bonds if it wants them to sell at par"