44 what is zero coupon bonds

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... What Is a Zero-Coupon Bond? Definition, Characteristics, and Example Zero-coupon bonds are stable as normal bonds, but they sell at a discount rather than offering interest payments. Contents. Bonds are financial instruments that allow investors to earn money by lending money to a government or a corporation for a certain period of time. Typically, bond issuers (governments and corporations) reward bondholders ...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

What is zero coupon bonds

What are Zero Coupon Bonds? Explain some of its variants. Zero-coupon bonds (ZCB), also known as deep discount bonds do not carry any coupon rate. They are issued at a discount and redeemable at par. The amount of discount is equal to the total return for the investor. This can be expressed in terms of interest rate, called the implicit or inherent rate of interest. What is a Zero Coupon Bond? - ICICIdirect Zero-coupon bond is a type of bond that governments and companies issue. Zero-coupon bonds, unlike other bonds, do not give investors a regular interest pay-out. Instead, they are issued at a steep discount to the bond's face value at the time of issuance. That is why they are also called discount bonds. Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

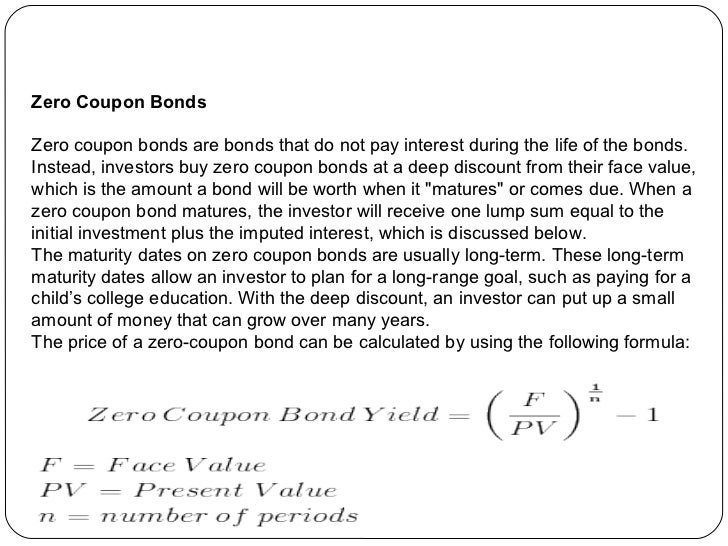

What is zero coupon bonds. Zero coupon bond definition — AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... How Are Zero Coupon Bonds Taxed In The Uk? - ictsd.org A zero coupon municipal bond ("a zero") is a zero coupon municipal bond redeemed at a deep discount for a medium- or long-term loan. States which issue zero coupon municipal bonds, the compounded interest is exempt from federal income taxes. If a bond is issued in your state, then you also don't pay state income taxes.

Explaining Zero-Coupon Bonds - Wolfline Capital A zero-coupon bond usually trades with a deeper discount than a regular bond and offers higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher yields than short-term bonds. To put things in perspective, regular coupon bonds' interest payments ... What are zero coupon bonds and why do people invest in them? Zero coupon bonds are a low-risk investment because the issuer has less incentive to default. Investors typically buy zero coupon bonds because they provide a higher rate of return than traditional bonds. Issuers sell zero coupon bonds at a discount and investors receive the full face value when the bond matures. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero Coupon Municipals Are About To Get Significantly Less Attractive Zero coupon bonds are those that don't pay a regular interest coupon. Instead they're issued at a discounted price which when held to maturity and repayment would equal a useful interest rate.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds can be Zero-coupon bonds for a specific period of time and then pay a certain interest for the remaining period till maturity. For example, a deferred coupon bond with 4 years as a deferred period with a coupon of 6% will not pay any interest for the first four years from the issuance date. After these initial 4 years, 6% ... Zero Coupon Bond - Explained - The Business Professor, LLC A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is sold at a significant discount from its face value. The trading value goes up as the bond approaches its priority date. The priority date is the date on which the bonds face value will be payable. Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

Zero-Coupon CDs: What They Are And How They Work | Bankrate How do zero-coupon CDs work? You'll pay a discounted price for a zero-coupon CD in exchange for not being paid interest throughout the term. You'll receive the full face value of the CD, plus ...

What Is a Zero-Coupon Bond? - Meity.Org Zero-Coupon Bond A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. KEY TAKEWAYS A zero-coupon bond is a debt security instrument that does not pay interest.

What Are Corporate Bonds? | Nasdaq Zero-Coupon Bonds Some bonds, called zero-coupon bonds, do not pay interest during the term of the bond. They are purchased for prices below par, then the par value is paid when the bond matures.

What is the tax implication on zero coupon bonds? - myITreturn Help Center Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ...

How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity.

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond.

› terms › zZero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

What Is a Zero Coupon Yield Curve? (with picture) A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond.

groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

it.wikipedia.org › wiki › Obbligazione_zero-couponObbligazione zero-coupon - Wikipedia Un'obbligazione zero-coupon (nota anche come Zero-Coupon Bond, abbreviato ZCB) è un'obbligazione il cui rendimento è calcolato come differenza tra la somma che il sottoscrittore riceve alla scadenza e la somma che versa al momento della sottoscrizione. Il nome deriva dal non pagamento di interessi (cioè niente cedole, inglese: coupon).

Zero Coupon Bond: Definition, Formula & Example - Study.com A zero coupon bond is a type of bond that doesn't make a periodic interest payment. In bond investing, the term 'coupon' refers to the interest rate repaid periodically to the bondholder. When Tom...

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

What is a Zero Coupon Bond? - ICICIdirect Zero-coupon bond is a type of bond that governments and companies issue. Zero-coupon bonds, unlike other bonds, do not give investors a regular interest pay-out. Instead, they are issued at a steep discount to the bond's face value at the time of issuance. That is why they are also called discount bonds.

What are Zero Coupon Bonds? Explain some of its variants. Zero-coupon bonds (ZCB), also known as deep discount bonds do not carry any coupon rate. They are issued at a discount and redeemable at par. The amount of discount is equal to the total return for the investor. This can be expressed in terms of interest rate, called the implicit or inherent rate of interest.

Post a Comment for "44 what is zero coupon bonds"