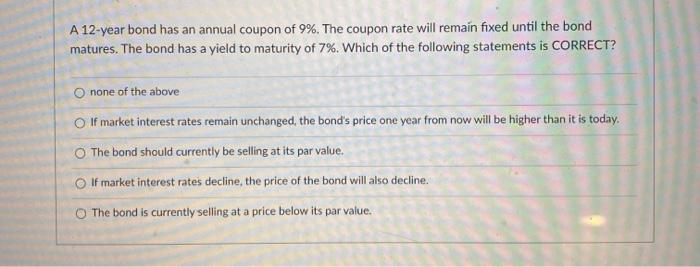

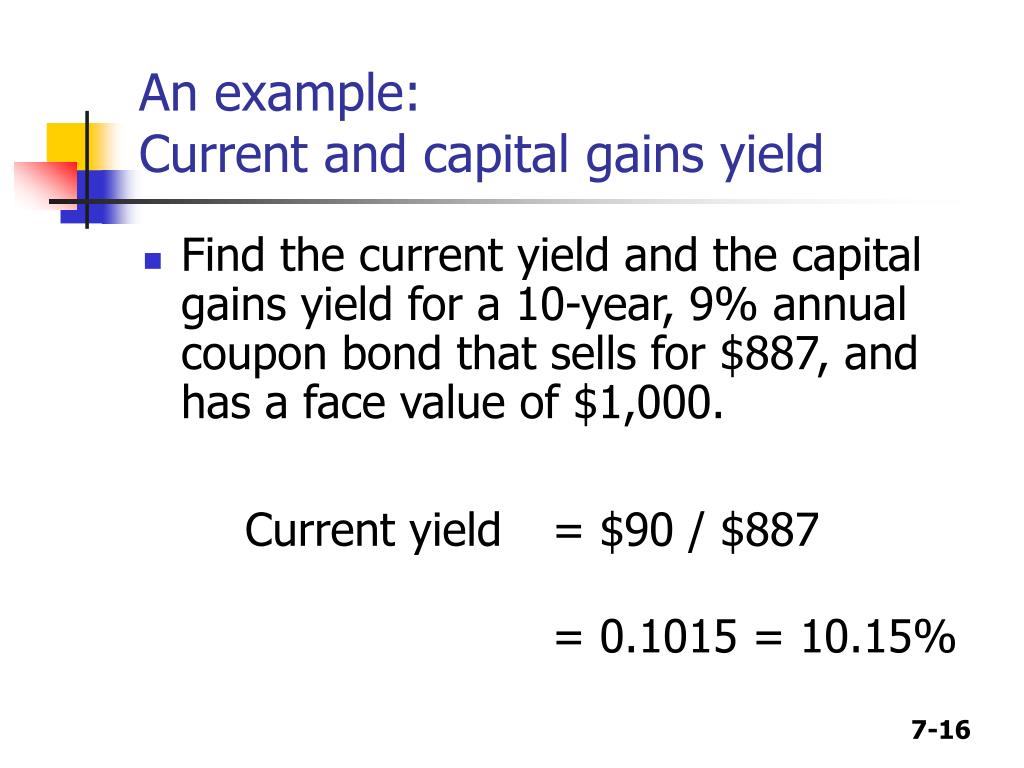

42 a 10 year bond with a 9 annual coupon

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved! www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading opportunities.

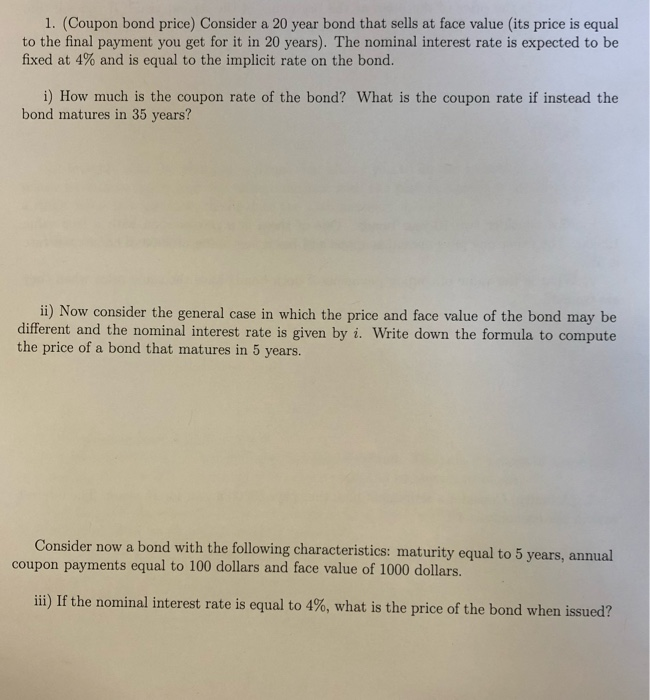

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

A 10 year bond with a 9 annual coupon

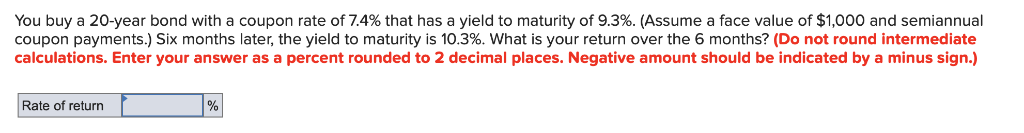

What is the current yield on a 3 year bond with 10% annual coupons, a ... Given: It is a three-year bond. Annual coupons % Issued at par at Current price . To find The current yield. Solution: Information that is provided states that these bonds were issued , at an annual coupon of % and the current rate is ; The formula for calculating the current yield is . × Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue. A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

A 10 year bond with a 9 annual coupon. Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. › Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par. How to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2 A 10-year $1,000 par value bond has a 9% semiannual - SolutionInn A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

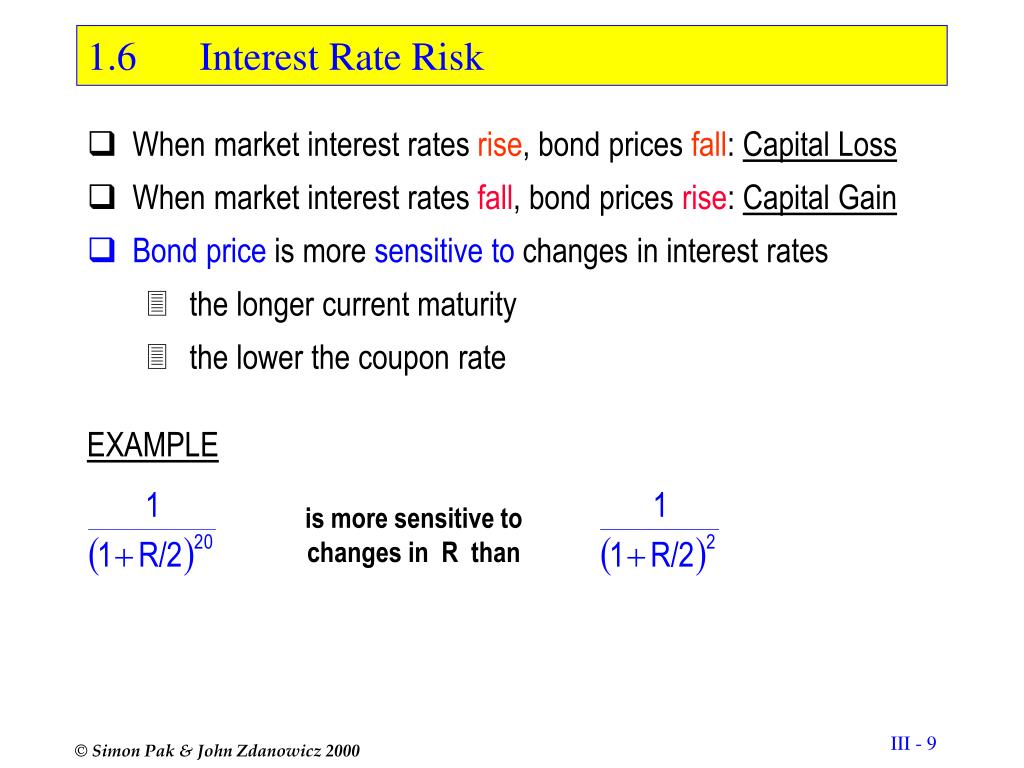

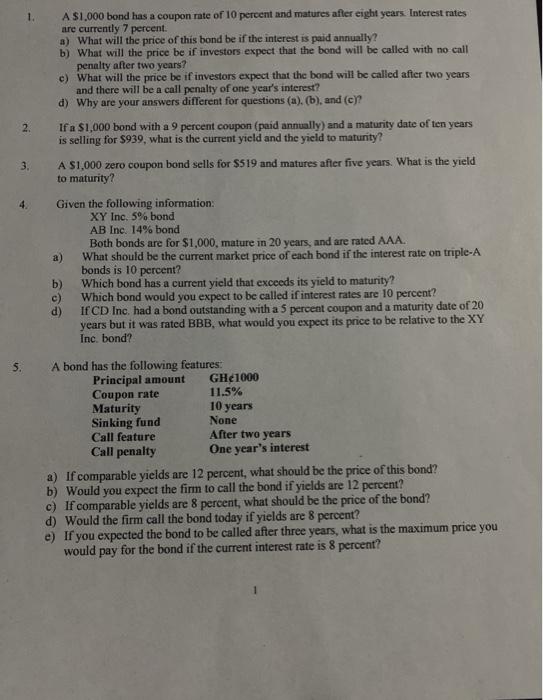

Chapter 7 Homework Finance Flashcards | Quizlet Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. Which of the following statements is CORRECT? a. Bond A's capital gains yield is greater than Bond B's capital gains yield. b. What is the price of a 10-year, 10% coupon bond with a $1,000 face ... What is the price of a 10-year, 10% coupon bond with a $1,000 face value if investors require a 12% return? Assume annual coupon payments. $565.00 $322.00 $604.50 $887.00 Show Result. Related MCQs? A curve on a graph with the rate of return on the vertical axis and time on the horizontal axis depicts ... -A 20-year, $1,000 par value bond has a 9% semi-annual coupon. Answer to A 20-year, $1,000 par value bond has a 9% semi-annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current. ... *2 7 8 Computation of price 6 years from now as follows: 9 Rate =B6/2 10 Nper =(20-6)*2 11 Pmt =1000*9%/2 12 FV 1000 13 Price =-PV(B9,B10,B11,B12) 📈What is the current yield on a 3 year bond with 10% annual coupons, a ... What is the current yield on a 3 year bond with 10% annual coupons, a par value of 100, and a current price of… Get the answers you need, now! faithomenka26 faithomenka26 07/04/2022 ... = Annual coupon amount / Bond price . Annual coupon: = 10% x 100 = $10. The current yield is: = 10 / 107.87 = 9.27%. Find out more on current yield at brainly ...

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price ? brainly.com › question › 27931387What is the yield to maturity for a 3 year bond with a 10% ... Jun 20, 2022 · The yield of maturity will be 10% itself , Option C is the right answer. The missing option are. What is the yield to maturity for a 3 year bond with a 10% annual coupon if the bond is trading at par? A) 11.00%. B) 9.00%. C) 10.00%. D) 9.75%. What is the meaning of Trading at Par ? At par means the bond or stock is trading at its face value , Answered: A 10-year, 12 percent semiannual coupon… | bartleby A 10-year, 12 percent semiannual coupon bond, with a par value of $1,000 sells for $1,100. What is the bond's yield to maturity? chapter5practicetest.docx - A 10-year bond with a 9% annual coupon has ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Select one: a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon ...

V a 10 year bond with a 9 percent semiannual coupon A 10-year bond with a 9 percent semiannual coupon is currently selling at par.10-year bond with a 9 percent annual coupon has the same risk, and therefore, the same effective annual return as the semiannual bond. If the annual couponbond has a face value of $1,000, what will be its price? A a. $ 987.12 b. $1,000.00c. $ 471.87d. $1,089.84e. $ 967.34

SOLVED: What is the price of a two year bond with a 9% annual coupon ... Hello, so here in this question, are we are asked: what is the price of a 2 year bond with a 9 percent annual coupon and a yield to maturity of 80 percent? So when calculating the price of a bond to keep in mind, the price is going to be equal to the present value of all the payments received by the bondholder from the issuer.

A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8%

› zero-coupon-bondZero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset For example, ABC Corporation could issue a 10-year, zero-coupon bond with a par value of $1,000. They might then sell it for $900. The purchaser would hold the note for 10 years and at the date of maturity would redeem it for $1,000, making $100 in profit. Bottom Line. A bond coupon rate can be a nice annual payout for a bond holder.

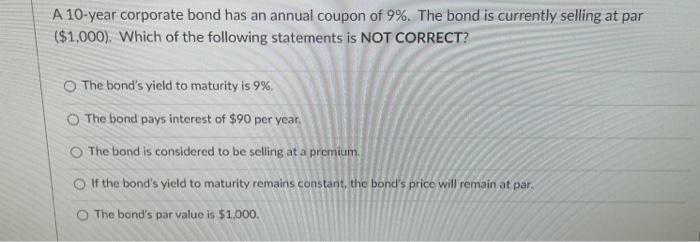

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? The bond's current yield is above 9%. The bond's yield to maturity is above 9%. If the bond's yield to maturity declines, the bond will sell at a discount. The bond's expected capital gains yield is zero.

What is the price of a two year bond with a 9% annual coupon and a ... What is the price of a two year bond with a 9% annual coupon and a yield to maturity of 8%? - 52405911. dorcasibrahimehi dorcasibrahimehi 14.06.2022 Accountancy Secondary School ... The coupon payments, which can be annual or semi-annual, the yield to maturity, the bond's life, and the face value are all important factors to consider. ...

A 10-year bond paying 8% annual coupons pays $1000 at maturity ... - Quora A 10-year bond paying 8% annual coupons pays $1000 at maturity. If the required rate of return on the bond is 7%, then today the bond will sell (rounded to the nearest cent) for what? Ad by The Penny Hoarder Should you leave more than $1,000 in a checking account? You've done it. You've built up a little cushion in your bank account — $1,000!

› finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

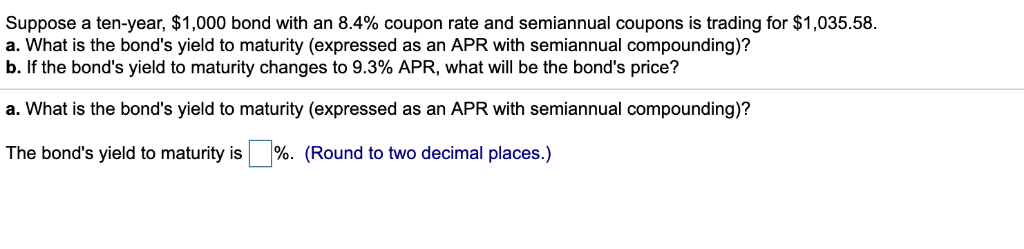

› bonds-payable › explanationCalculating the Present Value of a 9% Bond in an 8% Market Since n = 10 semiannual periods, you need to go to the column which is headed with the market interest rate per semiannual period. If the market interest rate is 8% per year, you would go to the column with the heading of 4% (8% annual rate divided by 2 six-month periods). Go down the 4% column until you reach the row where n = 10.

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates change, the price of the bond will fluctuate above...

A bond investor is analyzing the following annual coupon bonds: Annual ... A bond investor is analyzing the following annual coupon bonds: Annual Coupon Rate 6% Issuing Company Johnson Incorporated Smith, LLC Irwin Corporation 12% 9% Each bond has 10 years until maturity and the same level of risk. Their yield to maturity (YTM) is 9% Interest rates are assumed to remain constant over the next 10 years.

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more

Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue.

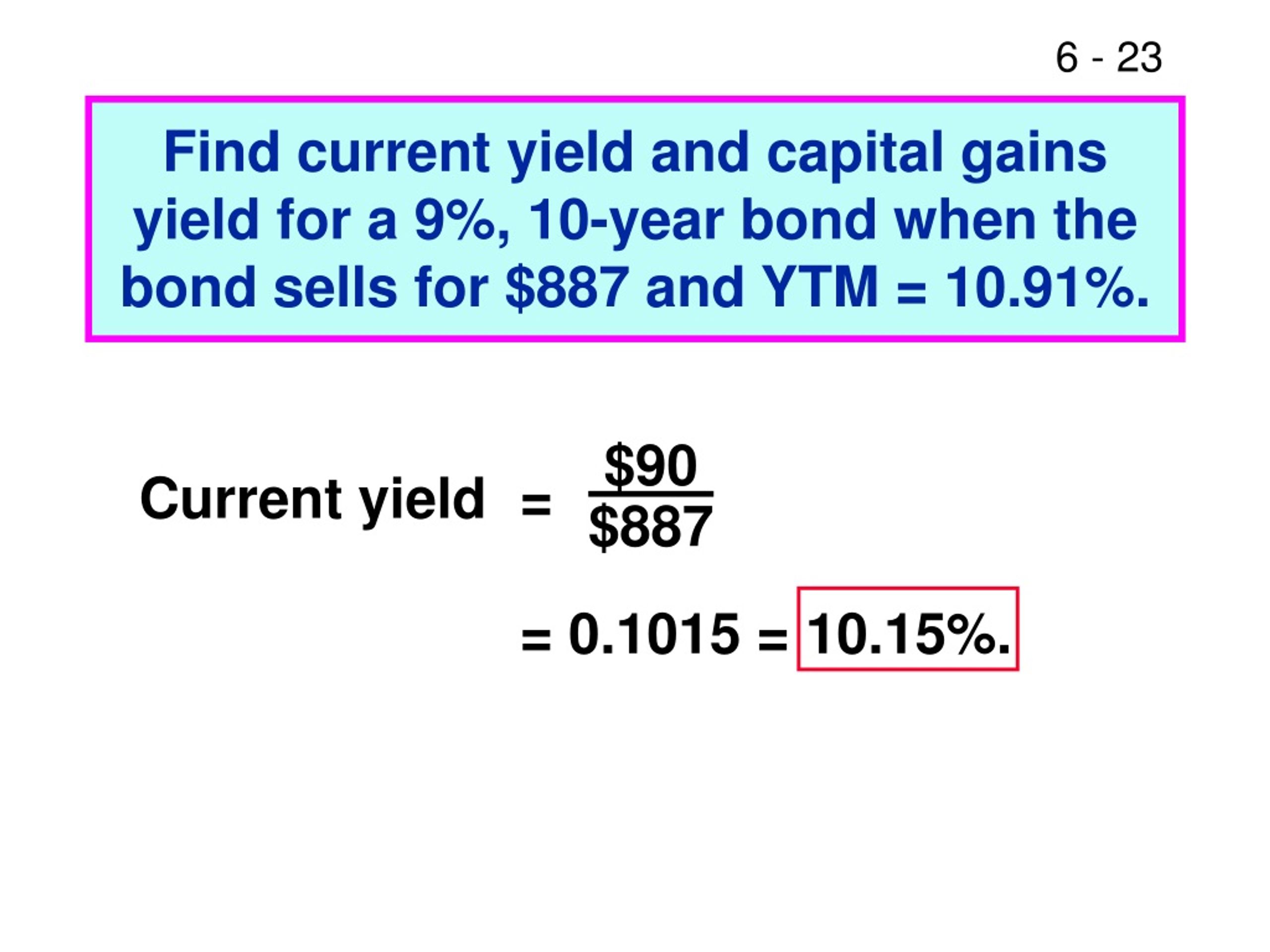

What is the current yield on a 3 year bond with 10% annual coupons, a ... Given: It is a three-year bond. Annual coupons % Issued at par at Current price . To find The current yield. Solution: Information that is provided states that these bonds were issued , at an annual coupon of % and the current rate is ; The formula for calculating the current yield is . ×

Post a Comment for "42 a 10 year bond with a 9 annual coupon"