41 perpetual zero coupon bond

Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds (bonds that...

en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.

Perpetual zero coupon bond

Perpetual Bonds - Overview, Issuers, Advantages, Disadvantages What are Perpetual Bonds? Perpetual bonds - which are also referred to as perpetuals or just "perps" for short - are bonds with no maturity date. They pay interest to investors in the form of coupon payments, just as with most bonds, but the bond's principal amount does not come with a set date for redemption (repayment). Types of Bonds | Boundless Finance | | Course Hero Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately. ... Perpetual bonds are also often called perpetuities or "perps. " They have no maturity date. US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Perpetual zero coupon bond. Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice. finra-markets.morningstar.com › BondCenter › DefaultBonds Home - Morningstar, Inc. Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ... 2022 CFA Level I Exam: CFA Study Preparation The Macaulay duration of a zero-coupon bond is its time-to-maturity. The Macaulay duration of a perpetual bond (perpetuity) is (1 + r) / r. Coupon rate is inversely related to Macaulay duration and modified duration. ... The exception is long-term, low coupon bonds, on which it is possible to have a lower duration than on an otherwise ... Is fiat currency the same as a perpetual zero coupon bond? Normal economic reasoning says a security that never pays any interest and never repays principal has zero value, since it never pays anything. But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." James Fineron

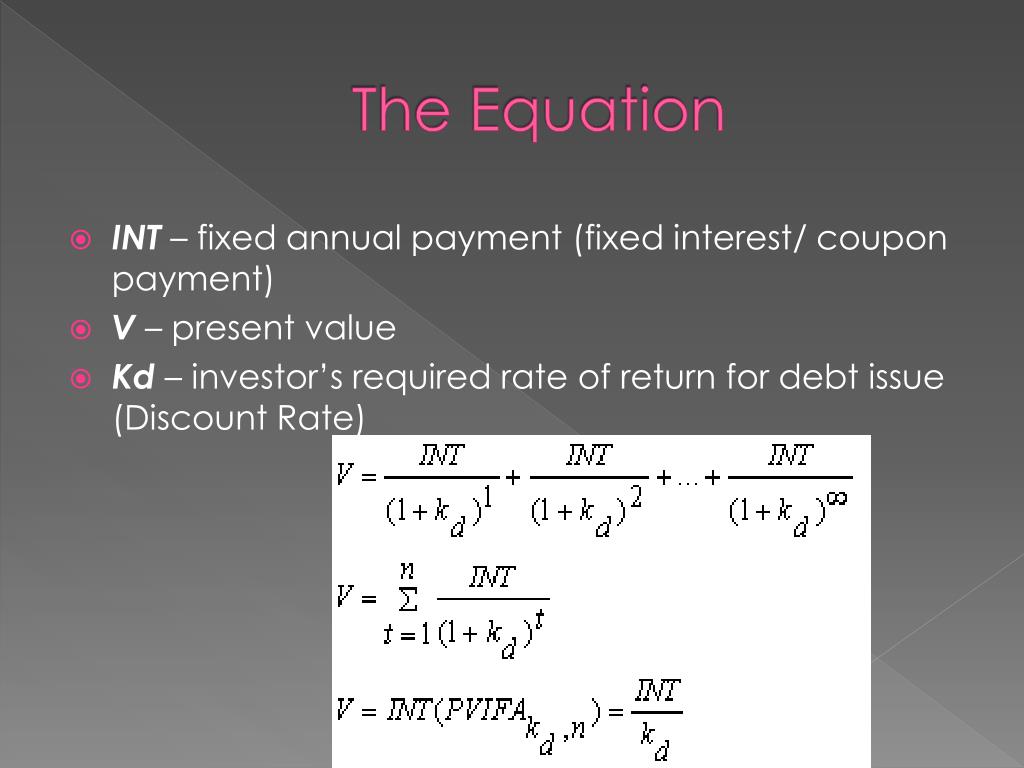

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ... Impossible Finance — The Zero Coupon Perpetual Bond - Medium The formula for calculating the value of a perpetual bond is shown below. D = Coupon per period r = discount rate n = number of periods i.e. infinity This is a very simple calculation for a Zero... PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP BOLI "zero coupon perpetual bond" is measured based on the purchase price to the expectancy of the eventual maturity value. The return on this bond is not necessarily that for the fair market value (cash value) as the fair market value is a subset of the eventual maturity value. The chart below provides a clear demonstration of this.

economics - perpetual bond that yields 0% - Personal Finance & Money ... They would ask how much would you pay for a perpetual zero coupon bond. The idea is you would pay zero for it since you don't get any coupons, and you never get your money back. Share. Improve this answer. Follow answered Mar 6, 2016 at 13:26. mirage007 mirage007. 371 1 1 ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Economist Gary Shilling mentioned holders of 30-year zero-coupon bonds purchased in the early 1980s outperformed the S&P 500 with dividends reinvested by 500% over the subsequent 30-years as interest rates fell from around 14.6% to around 3%. I started investing in 30 Year zero coupon treasuries. Now, zero coupon bonds don't pay any interest ... PDF Bonds - Finance Department » Pure discount or zero-coupon bonds - Pay no coupons prior to maturity. » Coupon bonds - Pay a stated coupon at periodic intervals prior to maturity. » Floating-rate bonds - Pay a variable coupon, reset periodically to a reference rate. zBonds without a balloon payment » Perpetual bonds - Pay a stated coupon at periodic intervals. International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD ... International bonds: Odebrecht Oil & Gas Finance, 0% perp., USD USG6712EAB41 Download Copy to clipboard Perpetual, Guaranteed, Trace-eligible, Zero-coupon bonds, Senior Unsecured Status Early redeemed Amount 1,758,820,530 USD Placement *** Early redemption *** (-) ACI on No data Country of risk Brazil Current coupon - Price - Yield / Duration -

en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ...

› gstripsInvest in G-SEC STRIPS India - Bondsindia.com The face value of a G-Strip Bond is Rs 1000. The bond bears a coupon rate of 9% with coupon payments being made at the end of each year. The maturity of the bond is 4 years. If the bond is redeemable at a premium of 11%. What would be the present market price of the bond?

Zero-Coupon Bond - Definition, How It Works, Formula What is a Zero-Coupon Bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest.

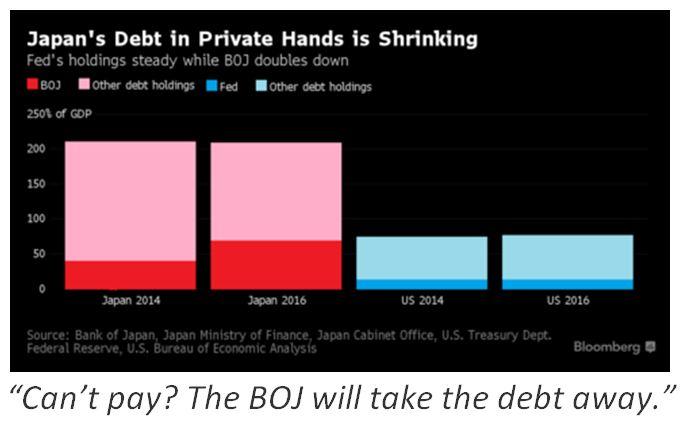

Greek debt "transformed into a zero-coupon perpetual bond" Credit Suisse: - Following the buyback, more than 80% of Greece's debt will be held by the official sector and seems to be in the process of being - for all practical purposes - transformed into a "zero-coupon perpetual bond".The average maturity on the EU/EFSF loans (which will soon represent 65% of Greek debt) is increased to 30 years, while there is a ten-year grace period.

Zero Coupon Perpetual (NYSEARCA:DXJ) | Seeking Alpha A zero-coupon perpetual bond would be revolutionary. "The hurdle to such extreme helicopter money measures is likely very high since they appear to be at odds with the spirit of Article 5 the...

What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 832 views View upvotes

Zero-coupon perpetual bonds? - Rudhar.com Zero-coupon bonds, with a redemption guarantee at the end of their maturity period, but no interest, may also make sense and be sought-after, in times of low interest rates and looming deflation. There is no yield, but there is the certainty, or at least the promise, that the same amount will be paid back after a predetermined period.

Domestic bonds: India, Bills 0% 22jun2023, INR (364D) IN002022Z127 The corporate sector is represented by Convertible Bonds, Non-Convertible Debentures (NCDs), Perpetual, Zero Coupon Bonds, Masala bonds, External Commercial Borrowings (ECBs) and Foreign Currency Denominated Bonds (FCBs). Indian companies also issue Eurobonds, securitized debt instruments, foreign bonds as well as quasi debt instruments like ...

investing - Why would zero-coupon perpetuity not be worthless (simple ... 2 The context is the negative yielding treasuries in Europe (Germany). Here is a quote I found on the matter: Why would a zero-coupon perpetuity not be worth exactly zero? Because its nominal value adds to the stock of debt of the issuer and so it is an option on recovery value - Michael Jezek, Deutsche Bank

› corporate-bondsCorporate Bonds: Meaning, Features and Benefits - BondsIndia Bonds having a credit rating of AAA to BBB are considered as Investment Grade Bond, others are considered as Non-investment Grade Bond. Coupon rate: Corporate bonds have higher coupon rates than G-secs. Normally, corporate bonds provide 7% (AAA rated) to 12% (A rated) coupons in the current year 2021.

Perpetual Bonds - Understanding the Basics - Track Live Bond Prices ... • Coupon step-up: A coupon step-up feature in perpetual bonds enables the investor to receive an increase or step-up in the coupon rate as per a pre-set schedule. Coupon step-ups can be one-step or multi-step. One-step bonds have their coupon increased once throughout the bond's lifetime. Multi-step bonds have multiple increases through ...

Calling Bitcoin a Ponzi Scheme is Lazy Thinking | by Alvin T ... What are zero-coupon perpetual bonds? They are a type of bond that, in theory, combines the features of zero-coupon bonds and perpetual bonds. Zero-coupon bonds: Bonds that do not pay interest but are issued at a discount vs the nominal value of the bond. On maturity, the bond issuer pays back the nominal value of the bond.

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

› terms › pPerpetual Bond Definition - Investopedia Mar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ...

PDF CMU CMU

Chancellor: Zero-coupon bonds are not a joke | Reuters The dollar bill, being an irredeemable non-interest bearing liability of the U.S. Treasury, is basically a zero-coupon perpetual. In his blog earlier this year Bernanke suggested that the Fed could...

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://scripbox.com/mf/wp-content/uploads/2020/12/zero-coupon-bonds.jpg)

Post a Comment for "41 perpetual zero coupon bond"