40 bond coupon interest rate

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050. › ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face ...

Bond coupon interest rate

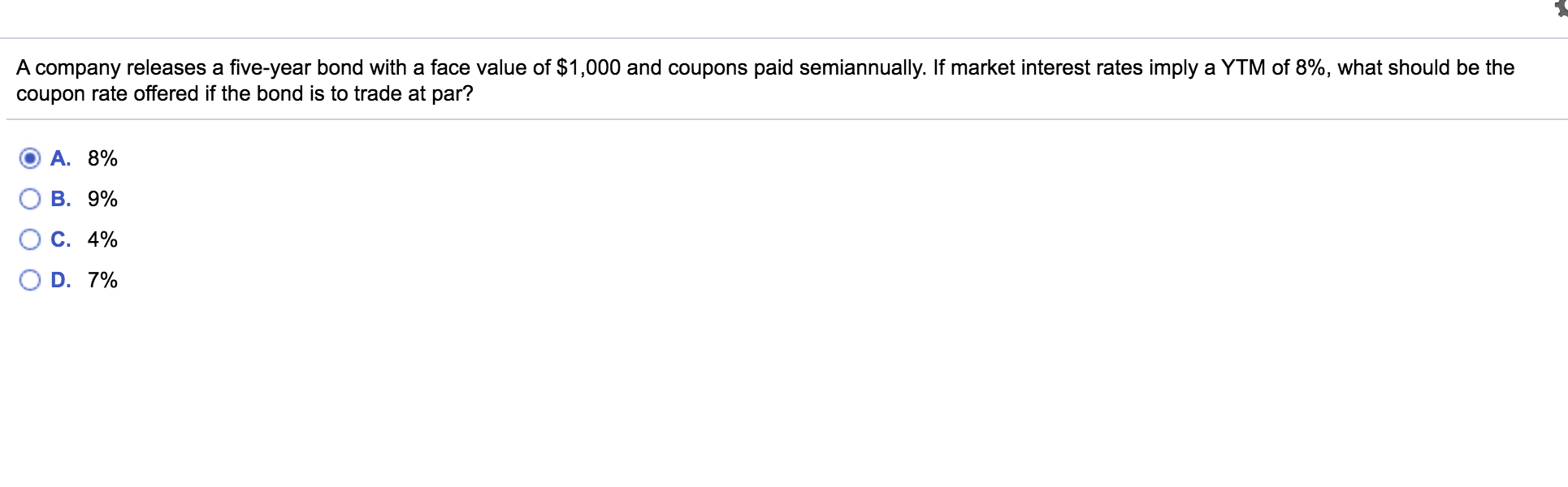

Rising bond yields: what happens to bonds when interest rates rise ... That fixed rate of bond interest is formally called a coupon rate. For example, a bond with a 4% coupon pays £4 per year on its principal of £100.2. The £100 principal is the amount loaned to the government in the first place, when the bond is issued. When the bond matures, whoever owns it at that point will get that £100 back. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. At Par - Overview, Bond Yields and Coupon Rates, Importance The coupon rate can be defined as the interest rate it yields. Par values are generally fixed at 100, in lieu of 100% of the face value of the $1,000 bond. So, when a bond is quoted or said to be trading at 100, it means that the bond is trading at 100% of its par value, which is $1,000. However, if a bond is said to be trading at 85, it means ...

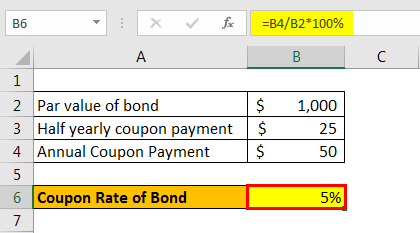

Bond coupon interest rate. › terms › zZero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. smartasset.com › investing › bond-coupon-rateWhat Is Coupon Rate and How Do You Calculate It? - SmartAsset Aug 26, 2022 · To calculate the bond coupon rate we add the total annual payments and then divide that by the bond’s par value: ($50 + $50) = $100; The bond’s coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond’s interest rate. I Bonds Rates Will Fall to 6.48% in November 2022 Using the formula below, we can determine the minimum rate an I Bond buyer would get starting in May 2022: Total rate = Fixed rate + 2 x Semiannual inflation rate + (Semiannual inflation rate X Fixed rate) Total rate = 0.000 + 2 x 4.81 + (4.81 x 0) Total rate = 9.62%. Earning 9.62% is a heck of a terrific deal!

Bonds, inflation and interest rates - what it all means for investors ... Here's a simple example. ABC plc bond is £100 and pays investors an annual coupon of 5%. In other words, you are receiving a yield (return) of 5%. If interest rates rise, the demand for the ... Zero Coupon Bonds: Know tax rules when such a bond is held till ... The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ... Interest Rate Risk Definition and Impact on Bond Prices - Investopedia Interest Rate Risk: The interest rate risk is the risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Fixing of coupon rates - Nykredit Realkredit A/S Effective from 20 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing. The new coupon rates will ... About Bonds Interest Rates Need to Know? - The Streameast The first is the coupon rate, which is the rate of interest that the bond pays out periodically. Yield to maturity, which is the rate of return you would get if you held the bond until it matured. ... Bonds, interest rate are everything in bond market. The bond market is very sensitive to changes in interest rate, and a small change can have a ... What Is a Bond? A Beginner's Investment Guide | Capital One A company's bonds may be investment grade, with less risk but a lower interest rate. Or the bonds might be non-investment grade, with more risk but a higher interest rate to motivate buyers. Corporate bonds may have fixed or floating interest rates. A fixed rate means that coupon payments will stay the same throughout the term.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond Formula. The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity=(Current Bond PriceFace Value)(Years to Maturity1) −1.

2 Year Treasury Rate - YCharts The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy. Historically, the 2 year treasury yield went as low as 0.16% in the low rate environment after the Great Recession. 2 Year Treasury Rate is at 4.28%, compared to 4.30% the previous market day and 0.35% last year.

Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data

Simple Math Terms for Fixed-Coupon Corporate Bonds - Investopedia This means a $1,000 corporate bond that has a fixed 6% coupon pays $60 a year for the duration of the bond. Most interest payments are made semiannually. So in this example, investors would likely ...

Bond Prices and Interest Rates | Moneyzine.com Regardless of the prevailing interest rates, the coupon on this bond is fixed at 5%, and the holder will receive $50 per year. In order to remain competitive with new issues, the bond would sell at a discount to its face value on the secondary market. To provide a potential buyer with a 7% yield, the price of the bond would have to decrease to ...

Bonds | FINRA.org When interest rates fall, bond prices generally rise. Every bond carries interest rate risk. One of the key determinants of a bond's coupon rate (the interest you receive) is the federal funds rate, which is the prevailing interest rate that banks with excess reserves at a Federal Reserve district bank charge other banks that need overnight ...

Savings I Bonds November 2022 Interest Rate: 6.48% Inflation Rate! If you buy before the end of October, the fixed rate portion of I-Bonds will be 0%. You will be guaranteed a total interest rate of 0.00 + 9.62 = 9.62% for the next 6 months. For the 6 months after that, the total rate will be 0.00 + 6.48 = 6.48% for the subsequent 6 months.

Attractive bonds: the coupons are back - Teller Report Attractive bonds: the coupons are back. 2022-10-20T06:35:40.736Z. ... The turnaround in interest rates has also reached the bond market. While KfW issued a five-year bond with a zero coupon in April, it was already 1.25 percent in June and now just 2.5 percent for a three-year term.

en.wikipedia.org › wiki › Bond_(finance)Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR).

Par Bond - Overview, Bond Pricing Formula, Example A bond's coupon rate is the rate of interest paid by the bond issuers on the bond's face value. To understand why a bond with a coupon rate equal to the market interest rate is priced at par, consider the following examples: Example 1: Discount Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 6%.

That Sky-High I Bond Interest Rate Will Be Coming Down to Earth In a few weeks, a little of the luster will fade. I Bonds would likely pay about 6.4% interest beginning Nov. 1 if the consumer-price index rises as economists expect by 0.2% monthly and 8.1% year ...

At Par - Overview, Bond Yields and Coupon Rates, Importance The coupon rate can be defined as the interest rate it yields. Par values are generally fixed at 100, in lieu of 100% of the face value of the $1,000 bond. So, when a bond is quoted or said to be trading at 100, it means that the bond is trading at 100% of its par value, which is $1,000. However, if a bond is said to be trading at 85, it means ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Rising bond yields: what happens to bonds when interest rates rise ... That fixed rate of bond interest is formally called a coupon rate. For example, a bond with a 4% coupon pays £4 per year on its principal of £100.2. The £100 principal is the amount loaned to the government in the first place, when the bond is issued. When the bond matures, whoever owns it at that point will get that £100 back.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 bond coupon interest rate"