43 treasury zero coupon bond

Zero-Coupon Bond: Definition, How It Works, and How To Calculate WebMay 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... iShares $ Treasury Bond 0-1yr UCITS ETF | IBTU iShares $ Treasury Bond 0-1yr UCITS ETF. Add to Compare. NAV as of 25/Nov/2022 USD 5.02. 52 WK: 5.00 - 5.02. 1 Day NAV Change as of 25/Nov/2022 0.00 (0.03%) NAV Total Return as of 24/Nov/2022 YTD: 0.52%. On 9 February 2021, one or more listing lines of this fund were delisted. Please refer to the shareholder letter found here for more information.

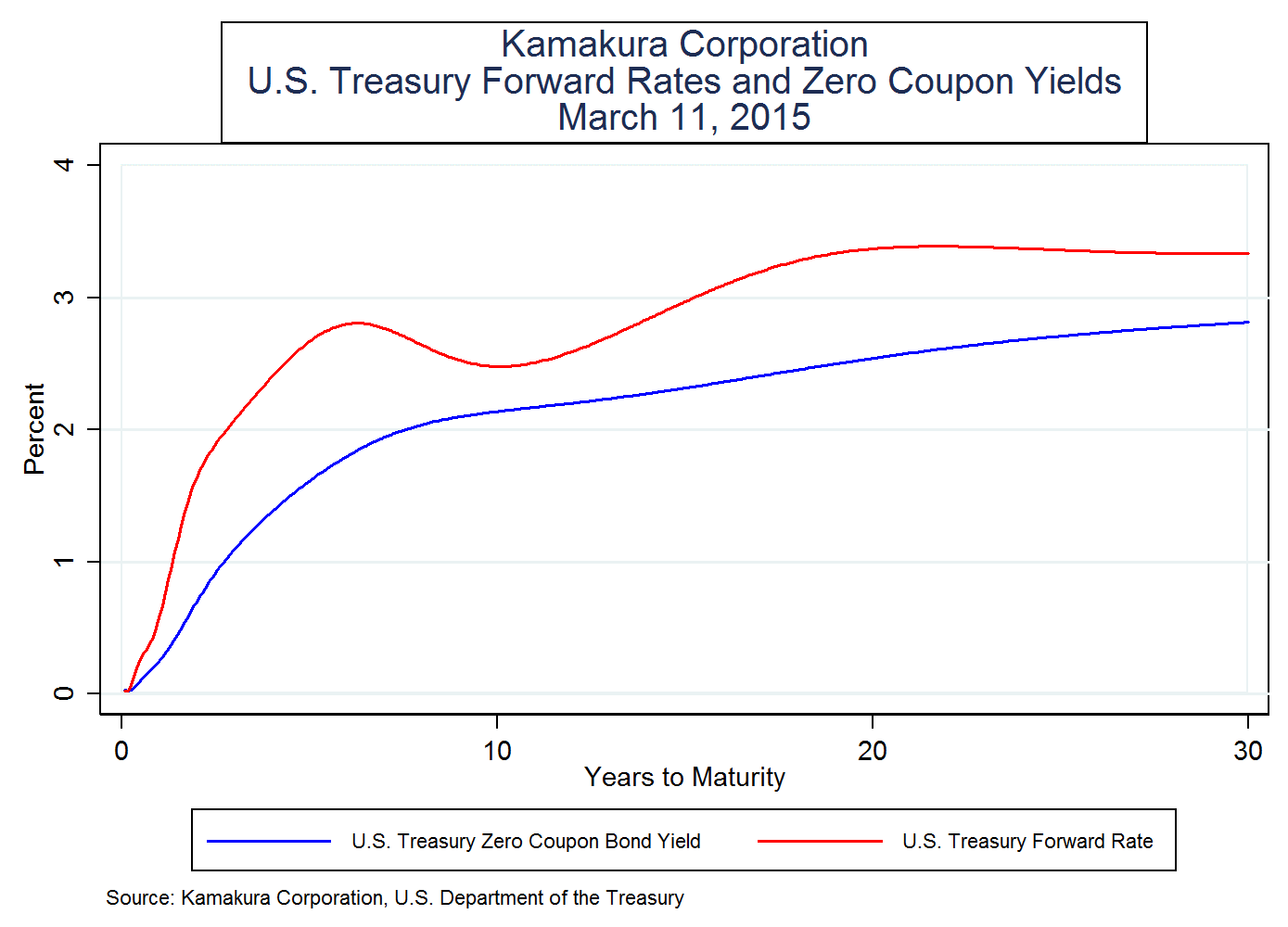

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury zero coupon bond

What are Zero-coupon Bonds? What is a Zero-Coupon Treasury Bond? Bonds are financial securities through which corporations, public bodies, or governments raise funding to meet the deficits in their spending requirements. Zero-coupon bonds issued by governments or quasi-government bodies (sovereign zero-coupon bonds) are called zero-coupon treasury bonds. Treasuries - WSJ WebMarket Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Treasury zero coupon bond. ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF - ETF.com Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news. Interest Rate Statistics | U.S. Department of the Treasury WebTreasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. The Basics of Bonds - Investopedia WebJul 31, 2022 · Treasury Bond (T-Bond) 7 of 28. ... Zero Coupon Bond: What's the Difference? 21 of 28. How Bond Market Pricing Works. 22 of 28. How to Create a Modern Fixed-Income Portfolio. 23 of 28.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ... United States Rates & Bonds - Bloomberg WebGet updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula P = M / (1+r)n variable definitions: P = price M = maturity value r = annual yield divided by 2 n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund … WebSep 30, 2022 · 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund. Loading... Share. ADD. PRINT. SUBSCRIBE. US Treasury. Sector. 2.60%. distribution yield. As of 09/30/2022 . 3.40%. 30-day sec yield As of 11/21/2022 ... Yield to Maturity (YTM) is the estimated total return of a bond if held to maturity. YTM accounts for the present …

Zero-coupon bond - Wikipedia WebA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero … ZROZ: Should Have 'First-Mover Advantage' When Treasury Rates Peak ZROZ is run by bond giant PIMCO. It aims to profit from the total return on the longest-term U.S. Treasury Bonds whose coupon payments are "stripped out," otherwise known as Zero Coupon Bonds. The ... US Treasury Zero-Coupon Yield Curve - Nasdaq US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 11 Nov 2022 Frequency daily Description These yield curves... Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia WebJan 31, 2022 · Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run returns of U.S. Treasuries. ... If a zero-coupon bond is purchased for $1,000 and ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and

How to Buy Zero Coupon Bonds | Finance - Zacks A bond with a face value of $1,000 purchased for $600 will yield $400 at maturity. Zero coupon bonds are issued by the Treasury Department, corporations and municipalities. The bonds are...

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Continued Treasury Zero Coupon Spot Rates — TreasuryDirect 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the Selected Asset and Liability Price Report under Spot (Zero Coupon ...

Treasury "Has Not Made Decision" Yet On Buybacks; Holds … WebNov 01, 2022 · The Treasury said that it "believes that current issuance sizes leave it well-positioned to address a range of potential borrowing needs, and as such, does not anticipate making any changes to nominal coupon and FRN new issue or reopening auction sizes over the upcoming November 2022 – January 2023 quarter."

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink The term "Zero Coupon Bond" has been defined by Section-2(48) of the Income Tax Act as below: - "Zero Coupon bond" means a bond: - (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005 (b) in respect of which no payment and benefit ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased...

Understanding Bond Prices and Yields - Investopedia WebJun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Treasuries - WSJ WebMarket Data Center. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

What are Zero-coupon Bonds? What is a Zero-Coupon Treasury Bond? Bonds are financial securities through which corporations, public bodies, or governments raise funding to meet the deficits in their spending requirements. Zero-coupon bonds issued by governments or quasi-government bodies (sovereign zero-coupon bonds) are called zero-coupon treasury bonds.

:max_bytes(150000):strip_icc()/GettyImages-932585920-5c910a5846e0fb000172f0e8.jpg)

![PDF] Zero Coupon Yield Curve Estimation with the Package ...](https://d3i71xaburhd42.cloudfront.net/099642ebfde435cc2d7b668516eea73c11bbd53b/13-Figure2-1.png)

Post a Comment for "43 treasury zero coupon bond"