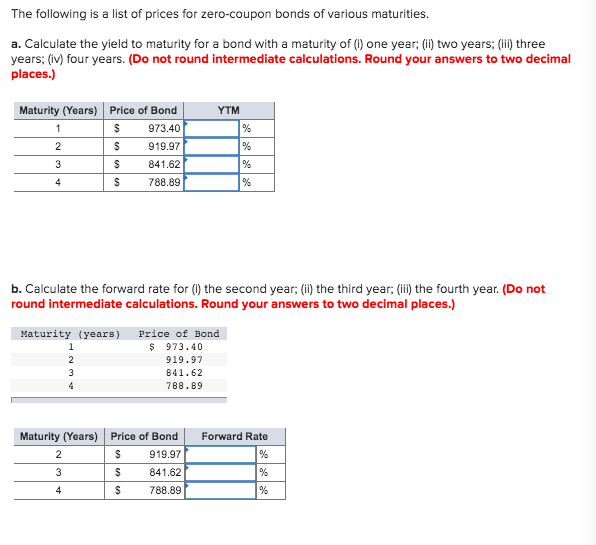

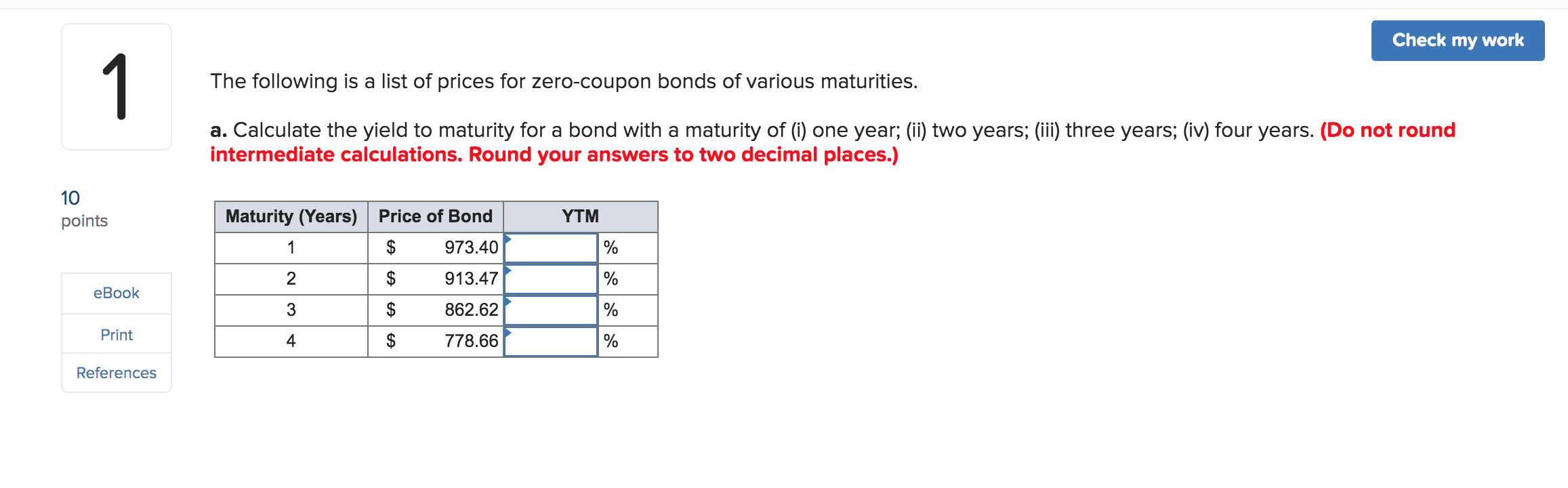

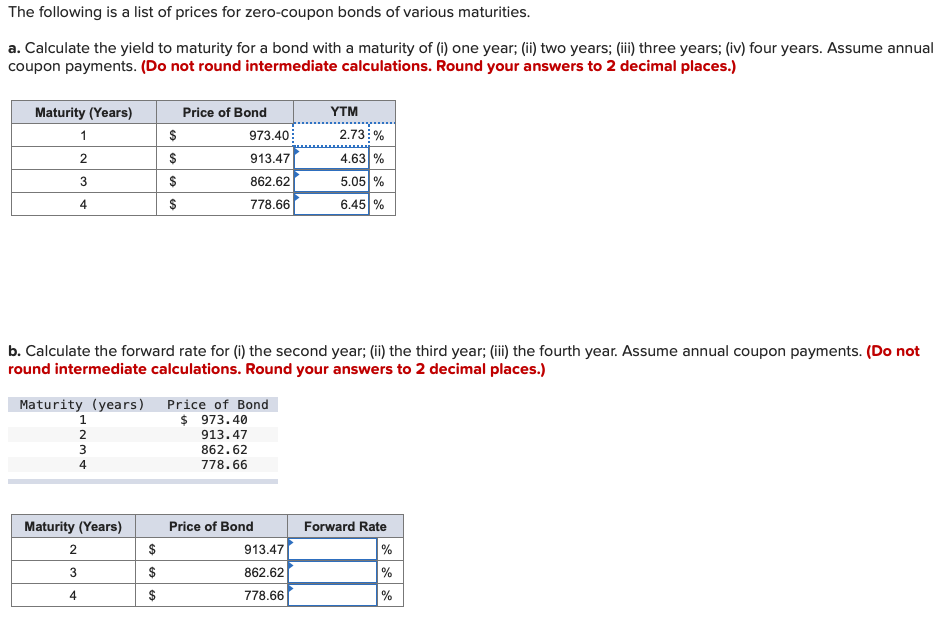

44 zero coupon bond yield calculation

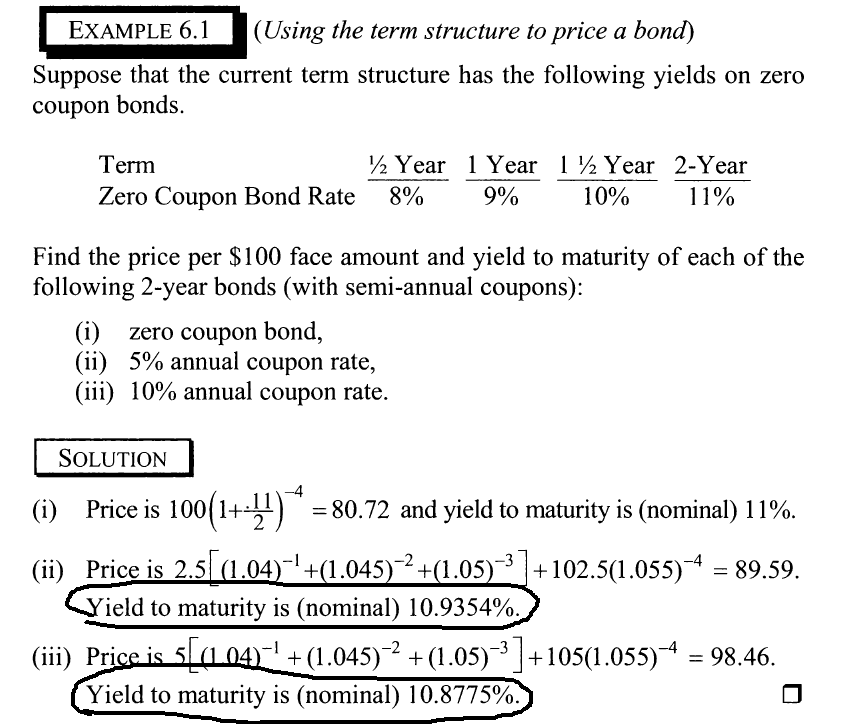

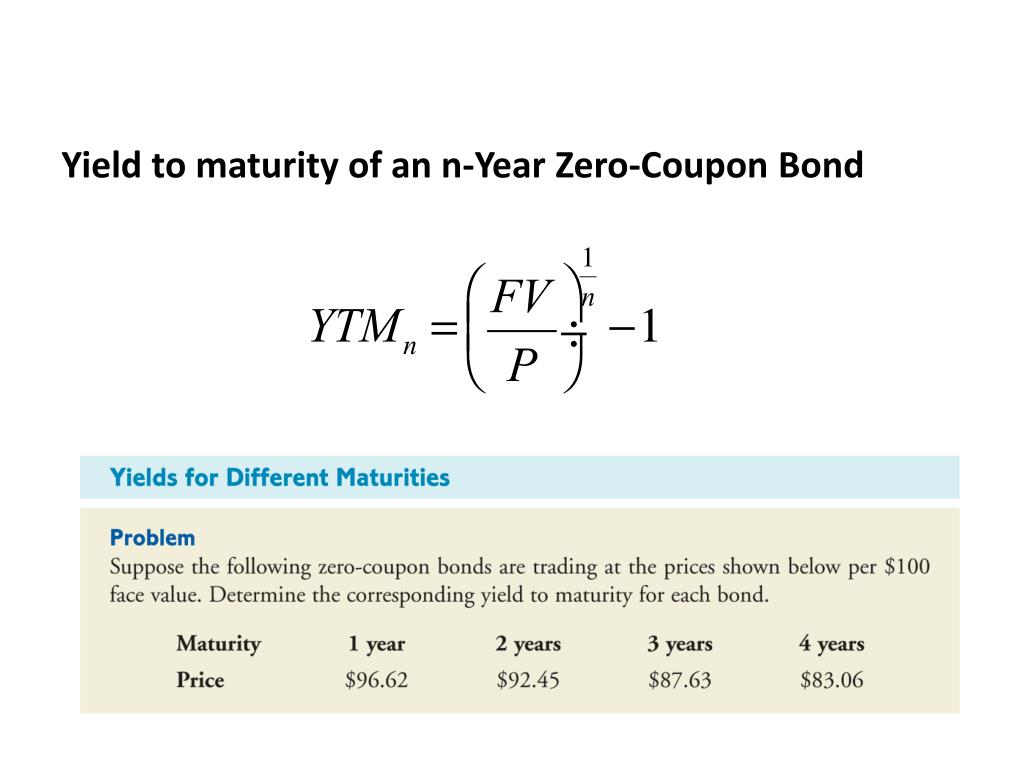

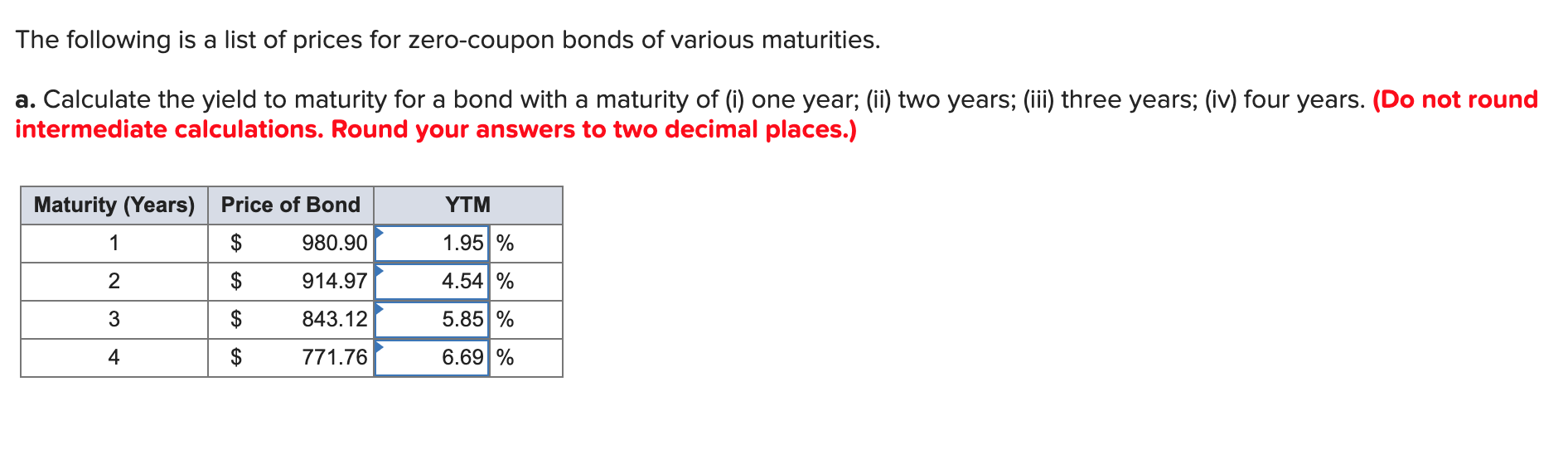

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Web= $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount … Zero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac {P} { (1+r)^t} (1+ r)tP where: P: The par or face value of the zero coupon bond r: The interest rate of the bond t: The time to maturity of the bond Zero Coupon Bond Pricing Example Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000

Zero coupon bond yield calculation

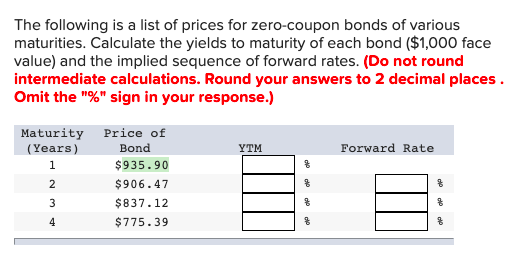

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five. Zero coupon yield - ACT Wiki 1 Jul 2022 — The zero coupon yield is equal to the current market rate of return on investments in zero coupon bonds of the same maturity. Example: Cash ...

Zero coupon bond yield calculation. Zero-Coupon Bond: Definition, How It Works, and How To Calculate Web31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Understanding Bond Prices and Yields - Investopedia Web28.06.2007 · As the price of a bond increases or decreases, the true yield will change—straying from the coupon rate to make the investment more or less enticing to investors. All else equal, when a bond's ... Bond Yield Calculator The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price. Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it should be multiplied with 0.01 to convert it from percent.

Calculation of the Value of Bonds (With Formula) - Your Article … WebThe realized yield to maturity can be illustrated in the following way: Par value of bond: Rs. 1,000 . Coupon rate Maturity: 10% p.a. Maturity: 5 years . Current Market Price: Rs. 600 . Reinvestment Rate of future cash flows: 12% . The future value of the bond is calculated in the following way: Future Value of Bond: Zero-Coupon Bonds: Characteristics and Calculation Example WebZero-Coupon Bond Yield Example Calculation. In our next section, we’ll work backward to calculate the yield-to-maturity (YTM) using the same assumptions as before. Model Assumptions. Face Value (FV) = $1,000; Number of Years to Maturity = 10 Years; Compounding Frequency = 2 (Semi-Annual) Zero Coupon Bond Effective Yield Calculator | StableBread Bond Pricing Calculator: Clean/Flat Price, Dirty/Market Price, and Accrued Interest. Credit Spread Calculator. Current Yield Calculator. Tax-Equivalent Yield (TEY) Calculator. Yield to Call (YTC) Calculator. Yield to Maturity (YTM) Calculator. Zero Coupon Bond Effective Yield Calculator. Zero Coupon Bond Value Calculator. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Step 1: Calculation of the coupon payment Annual Payment =$1000*5% Annual Payment =$50 Step 2: Calculation of bond yield =$50/$970 Bond Yield will be - =0.052*100 Bond Yield =5.2% Hence it is clear that if bond price decreases, bond yield increases. Recommended Articles This has been a guide to Bond Yield Formula. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. Zero coupon yields – explanation of the calculations 12 Apr 2021 — Treasury bills (zero coupon securities) and government bonds (coupon securities). Norges Bank calculates zero coupon yields using a ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods

Government Bond Yield Curve - The Thai Bond Market Association WebZero Coupon Yield Curve; Indicative Intraday Yield Curve; US Treasury Yield Curve; Dot Plot Yield Curve; SOE Spread Matrix; Bond Quotation; Bond Index. ... IRR Calculation; Bond Price. Search by Bond; Month-end MTM Prices; ASEAN+3 Bond Info; Bond Info . Issuer Search; Registered Bond. Registered Bond; Bond Information;

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Zero Coupon Bond Effective Yield Calculator Zero Coupon Bond Effective Yield is used to calculate the periodic return for a zero-coupon bond, or sometimes referred to as a discount bond and is represented as ZCB Yield = (F/PV)^ (1/n)-1 or Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

How do I Calculate Zero Coupon Bond Yield? The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Bond Purchase Date (DD/MM/YYYY) Bond Maturity Date (DD/MM/YYYY) % p.a. Note: The yield calculated by this calculator is Excel's XIRR equivalent annualized yield for the actual duration of the bond. For periods less than one year, the calculator returns Money Market Yield. Use Bond YTM Calculator for calculating yield on a coupon paying bond.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … WebEnter the face value of a zero-coupon bond, the stated annual ... to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M ...

Yield to Maturity – What it is, Use, & Formula - Speck & Company There are two formulas for yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [(Face Value / ...

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Web31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond...

Zero Coupon Bond Calculator - Calculator App Imputed Interest Calculator; Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value; F is the face value of the bond; r is the yield/rate; t is the time to maturity; Zero Coupon Bond Definition. A zero-coupon bond is a security that does ...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Par Value: $1000 Years to Maturity: 3 Annual Coupon Rate: 0% Coupon Frequency: 0x a Year Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an...

Zero Coupon Bond Yield Calculator - Find Formula, Example & more The yield of the bond will be. The formula is: Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the bond will provide the investor with a yield of 7.39%

Bond Yield Calculator | Calculate Bond Returns Calculate the bond yield. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at the same interest rate. Hence, the bond yield formula involves deducing the bond yield r in the equation below: bond price = Σ k=1n [cf / (1 + r) k], where.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o...

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

Bond Yield: What It Is, Why It Matters, and How It's Calculated Web31.05.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

How to Calculate the Price of a Zero Coupon Bond First, divide 6 percent by 100 to get 0.06. Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236. Lastly, divide the face value of $2,000 by 1.1236 to find that the price to pay for the zero-coupon bond is $1,880. 00:00 00:00.

Zero Coupon Bond Calculator - MiniWebtool It is also called a discount bond or deep discount bond. Formula The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t Where: F = face value of bond r = rate or yield t = time to maturity

Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 · To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Yield To Maturity Calculator 778066 Coupon Bond Yield ... Surface Studio vs iMac - Which Should You Pick? 5 Ways to Connect Wireless Headphones to TV. Design

Zero coupon yield - ACT Wiki 1 Jul 2022 — The zero coupon yield is equal to the current market rate of return on investments in zero coupon bonds of the same maturity. Example: Cash ...

How to Calculate the Yield of a Zero Coupon Bond Using Forward Rates? So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%. So we're just taking (1 + the forward rate) for each of these periods. It's a five-year zero-coupon bond so we're gonna go all the way up to forward rate through year five.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ WebP: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Post a Comment for "44 zero coupon bond yield calculation"